Streaming Content Strategy & Business Performance

Netflix Case Study

Tools: Python, Pandas, Plotly, matplotlib, scikit-learn, Dash

Overview

This project explores how streaming platforms balance content quality, production scale, and global expansion to drive business performance.

Using Netflix as a case study, I analyzed whether traditional quality signals (such as IMDb ratings) meaningfully relate to business outcomes, or whether platform growth is increasingly driven by content volume, localization strategy, and user engagement dynamics.

To investigate this, I combined three datasets:

Netflix Movie & TV Show Data (content production & metadata)

IMDb Ratings Data (quality assessment)

Netflix Stock Price Data (business performance)

As the leading global streaming platform, Netflix’s content strategy evolution offers insight into broader shifts in how digital entertainment businesses optimize content investment and growth strategy.

Visualizations

Netflix IMDb Score Trend Over Time

-

The average IMDb score of Netflix content has declined steadily since 2015, indicating a possible overall drop in content quality.

Movie vs. TV Show Production Trend

-

Netflix has significantly increased the volume of content released on its platform since 2015, especially in movies.

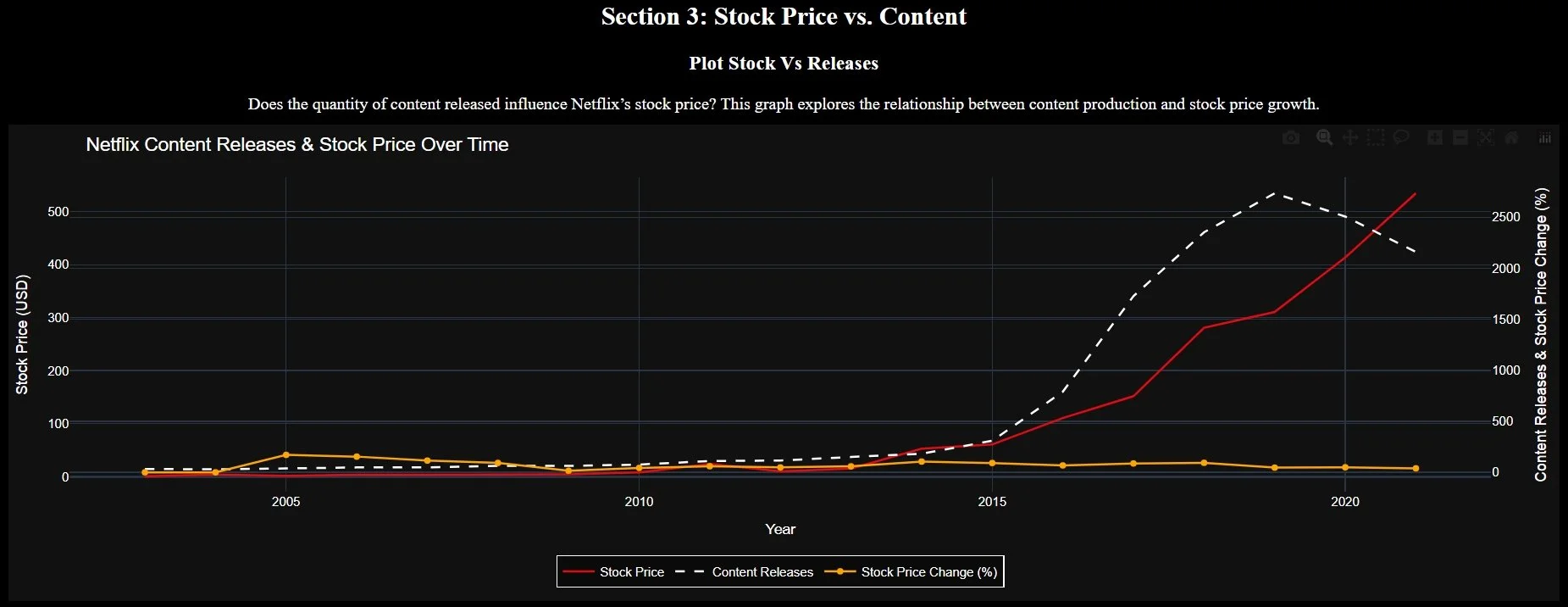

Netflix Content Releases & Stock Price Over Time

-

There appears to be a positive correlation between the number of content releases and Netflix’s stock price, especially after 2015. This suggests that increasing content volume may have contributed to investor confidence and stock growth.

Does Content Quality Affect Stock Volatility?

-

In Netflix’s early years, higher IMDb scores correlated with increased stock volatility (Corr = 0.31), suggesting content quality once influenced investor sentiment.

However, post-2015, this correlation turns negative (Corr = -0.15), implying that broader business factors now outweigh content ratings in driving stock movements.

Netflix Annual Hit Shows vs. Stock Price - Long-term

-

There is no clear long-term correlation between the number of hit shows and stock performance. Netflix's stock price continues to rise steadily, regardless of fluctuations in the number of hit releases.

Trend of International Content Over Time

-

Netflix’s international content ratio surged after 2015, aligning with its global expansion into 190+ countries by 2016. This reflects a strategic shift toward localized content production for global markets.

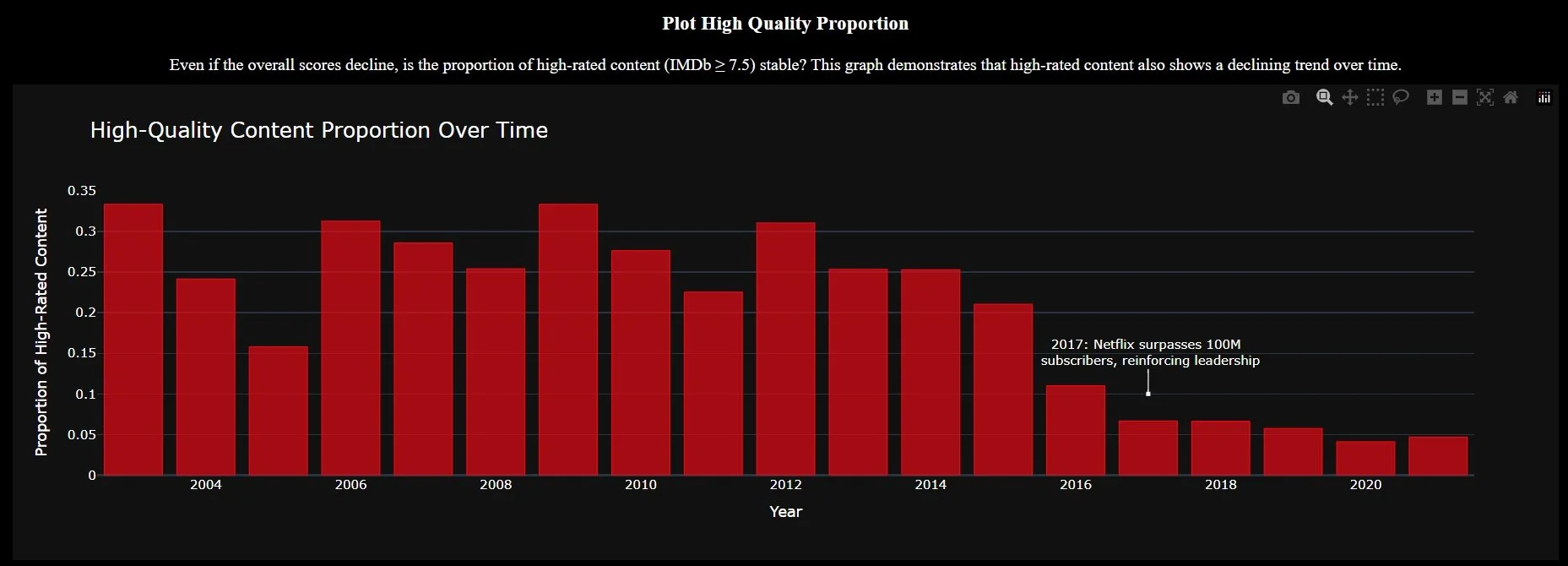

High-Quality Content Proportion Over Time

-

The proportion of high-rated content (IMDb ≥ 7.5) has declined over time, especially after 2015, further supporting the trend of diminishing content quality on Netflix.

Movie vs. TV Show IMDb Score Trend

-

TV shows consistently receive higher IMDb ratings than movies on Netflix. This may reflect higher production quality, more curated storytelling, or more selective viewer engagement.

Additionally, TV shows tend to span multiple episodes or seasons, offering long-term engagement that helps retain subscribers—making them strategically more important to the platform.

Netflix High-Quality Content & Stock Price Over Time

-

High-quality content (IMDb ≥ 7.5) does not show a strong correlation with stock price movements. This implies that stock performance is more influenced by expansion strategies, market positioning, and subscriber growth rather than consistent critical acclaim.

Impact of Hit Shows on Netflix Stock - Short-term

-

Despite the success of blockbuster shows (IMDb ≥ 8.0, ≥ 100k votes) , Netflix’s stock price shows no clear short-term jumps.

This suggests that hit content does not significantly impact stock prices in the short term.

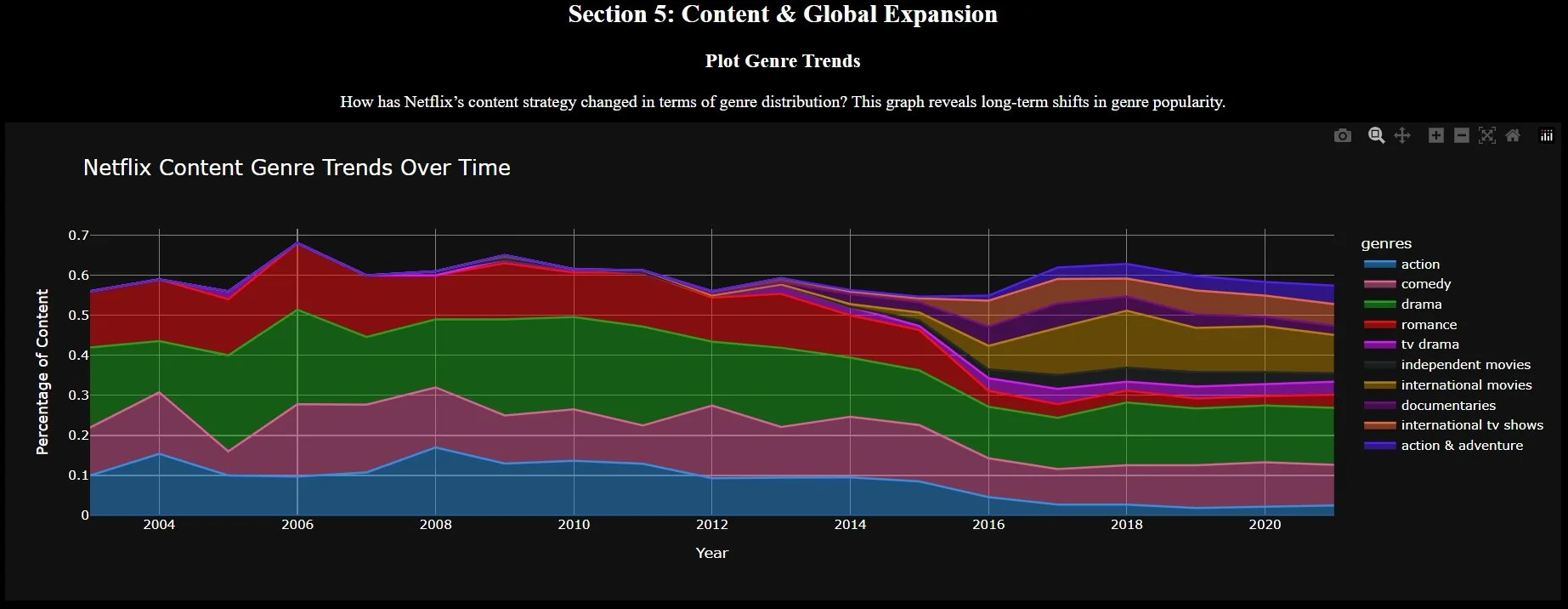

Netflix Content Genre Trends Over Time

-

Since 2015, Netflix has diversified its genre offerings significantly. The rise of international TV shows, documentaries, and non-English content suggests a deliberate global expansion strategy and content localization.

Netflix Content Production Growth by Country - 2003 to 2021

-

Netflix’s content production has geographically diversified. While the U.S. still dominates, Europe and parts of Asia (like South Korea, India, Japan) now contribute significantly more than in the early 2000s.

Analysis Summary

Section 1: Has Netflix's Content Quality Changed?

Since around 2015, Netflix has shown a clear shift in strategy—from prioritizing fewer high-rated releases to expanding overall content volume. Both the average IMDb rating and the proportion of high-quality titles (IMDb ≥ 7.5) have declined steadily, especially post-2016.

This trend coincides with Netflix's transformation from a content curator into a global streaming platform. Instead of emphasizing a few prestigious titles, the platform now focuses on breadth, variety, and personalized content to serve a diverse and international user base.

The decline in average ratings should not be interpreted as a straightforward drop in content quality. Instead, it reflects a structural evolution in Netflix’s strategy—one shaped by platform-scale growth and global diversification.

Section 2: How Does Content Influence Netflix’s Stock Performance?

Data shows that Netflix’s stock price does not respond directly to changes in content quality. Whether measured by average ratings, high-score proportions, or individual hit shows, the correlation with stock movement is weak.

In contrast, content quantity—especially the increase in total releases—shows a modest positive relationship with stock performance. This suggests that Netflix’s investor narrative is more aligned with growth, user engagement, and retention than critical acclaim.

In the early years (pre-2010), content quality had more noticeable influence. But in the platform’s maturity phase (post-2015), stock performance has been increasingly driven by financial reports, subscriber growth, and global positioning.

Thus, the impact of content is indirect: Content → User Growth / Retention → Financials → Stock Price

Section 3: Why Did Netflix Shift Its Content Strategy?

Netflix’s content strategy has shifted from focusing mainly on U.S.-based, limited-genre content to building a more global and diverse catalog. Since 2015, the share of international productions has grown significantly, and by 2020, non-U.S. content made up a large part of the platform’s offerings.

At the same time, Netflix expanded its range of genres—from mainly drama and comedy to include more documentaries, independent films, and international series. This change supports its global expansion and helps meet the tastes of a wider international audience.

These shifts also affect how audiences rate content. Differences in cultural background, viewer preferences, and rating habits across regions may help explain the drop in average IMDb scores. Rather than showing a drop in content quality, the lower scores likely reflect changes in content structure and audience diversity.

Insights

Netflix’s average content ratings have declined in recent years, but this should not be mistaken for a simple drop in quality. Instead, it reflects a structural shift in content strategy. As a subscription-driven global streaming platform, Netflix is not a traditional film studio. Its content ecosystem is built around user retention, discovery, and conversion—not critical acclaim.

Rather than aiming for every title to be a high scorer, Netflix focuses on producing or acquiring a large volume of “85-point” content—mid-to-high-quality shows and films that, when delivered in diverse formats and updated frequently, help sustain user engagement and subscription growth. This approach improves distribution efficiency and lowers churn.

Algorithm-Led Distribution Strategy

Netflix’s recommendation algorithm plays a central role in shaping what users watch. The platform prioritizes content relevance over average rating. As a result, mid-tier and long-tail content are more likely to be recommended if they align with user interests—even if their average ratings are not the highest.

Rating ≠ Success. What matters more is: relevance × reach × conversion.

Globalization Means Localized Content

Netflix’s global expansion is not about exporting American values worldwide. Instead, it builds a decentralized and multicultural content network through local productions, regional acquisitions, and multilingual releases. Localized content is not only more cost-effective but also drives stronger emotional connection and word-of-mouth in each market.

There is no universal definition of “good content.” Netflix aims for reach across diverse standards—not one global aesthetic.

From Consumption to Participation

Today’s users want more than just content to watch—they seek stories they can follow, characters they connect with, and communities they can join. This makes serialized shows, local IPs, and multi-season formats more valuable. Netflix, in turn, strengthens its hold over user engagement and content life cycles.

Success = Viewership + Resonance + Participation. Netflix’s content structure is designed for long-term involvement, not just one-time viewing.

Content ROI and Financial Optimization

To ensure sustainable growth, Netflix leans toward content with a higher return on investment—such as non-English titles, international co-productions, and so on. These formats typically come with lower production costs, higher local engagement, and more manageable risks. It’s a strategic trade-off: sacrificing high ratings for better unit economics.

Lower average scores can be a rational choice in exchange for higher margins and controlled risk.

Limitations

Public rating data may not fully represent user engagement behavior.

Internal metrics like watch time and retention are not publicly available.

Stock performance is influenced by multiple macro and business factors beyond content strategy